The Security Benefits of USSD Codes for Mobile Transactions

Unlocking

the potential of mobile transactions has revolutionized the way we handle our

finances. With just a few simple taps on your phone, you can transfer funds,

pay bills, and make purchases - all from the comfort of your own home. But as

convenient as these services are, security remains a top concern for many

users. This is where USSD codes come into play. In this blog post, we'll

explore how USSD codes provide an extra layer of

security for mobile transactions while ensuring that your personal information

stays safe and sound. So grab your smartphone and let's dive into the world of

USSD codes!

How secure is USSD code?

When it

comes to mobile transactions, security is of utmost importance. And USSD codes

offer a secure way to conduct these transactions. But just how secure are USSD

codes?

USSD (Unstructured Supplementary Service Data) codes provide an extra layer of

security for mobile transactions. Unlike other methods that require internet

connectivity, USSD works via a direct communication channel between your phone

and the service provider's server. This means that your transaction data is not

transmitted over the internet, making it less susceptible to hacking or

interception.

Furthermore, every USSD session is encrypted end-to-end, ensuring that your

personal and financial information remains confidential during the transaction

process. This encryption adds another level of protection against unauthorized

access.

Additionally, most banks and financial institutions have implemented

multi-factor authentication for USSD-based mobile banking services. This means

that along with entering the USSD code, users must also enter their unique PIN

or password to authorize any transaction. This further enhances the security

aspect by preventing unauthorized access even if someone gains access to your

phone.

While no system is entirely foolproof when it comes to security, USSD codes

provide a robust and secure method for conducting mobile transactions with

added layers of encryption and authentication measures in place.

What are the benefits of USSD code?

USSD codes,

or Unstructured Supplementary Service Data codes, offer a range of benefits for

mobile phone users. When it comes to retrieving important information or

performing various tasks on your mobile device, USSD codes provide a quick and

efficient way to access these services without the need for internet

connectivity or complex procedures. Specifically, in relation to "Lycamobile PUK Code,"

here are some advantages:

Convenience:

USSD codes offer a convenient way to access essential services like retrieving

your Lycamobile PUK (Personal Unblocking Key) code. By simply dialing the

relevant USSD code, you can quickly get the PUK code you need without having to

visit a physical store or contact customer service.

No Internet

Required: Unlike many other methods that might require an internet connection

or mobile data, USSD codes function over the cellular network. This makes them

particularly useful when you're in areas with poor or no internet connectivity.

Instant

Access: USSD codes provide instant access to information and services. Dialing

the code initiates a real-time interaction with the network, allowing you to

get the required information promptly. This is especially crucial when you're

in situations that require immediate assistance, such as when your SIM card is

locked and you need the PUK code to unlock it.

User-Friendly:

USSD codes are generally easy to use, as they involve dialing a short code on

your phone's keypad. This user-friendly approach eliminates the need for

complex procedures or navigating through menus, making it accessible to a wide

range of users.

Cost-Effective:

Using USSD codes is often cost-effective, as they are typically included in

most mobile service plans without incurring additional charges. This makes them

a budget-friendly option for obtaining important information like your

Lycamobile PUK code.

Security:

USSD codes are designed to be secure, ensuring that the information you

retrieve or the tasks you perform are transmitted securely over the cellular

network. This is particularly important when dealing with sensitive information

like PUK codes.

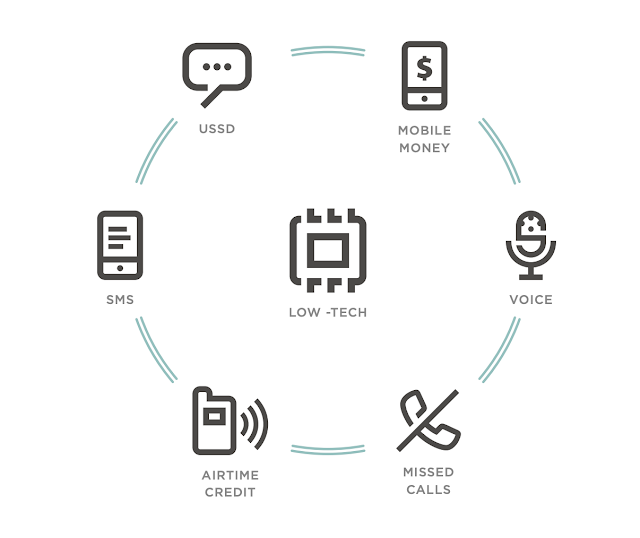

What is the use of USSD based mobile transactions?

USSD-based

mobile transactions have become increasingly popular in recent years, offering

a convenient and secure way to carry out various financial activities using

just a simple code. With USSD codes, users can perform tasks such as checking

account balances, transferring funds, paying bills, and even purchasing goods

and services directly from their mobile devices.

One of the key advantages of USSD-based mobile transactions is their

accessibility. Unlike other methods like internet banking or mobile apps that

require an internet connection or specific software, USSD codes can be used on

any type of phone – even basic feature phones without internet access. This

makes it a widely accessible option for individuals who may not have access to

smartphones or stable internet connections.

Furthermore, USSD-based transactions are highly secure. The technology uses

encryption protocols to ensure the privacy and confidentiality of user data

during the transaction process. Additionally, since USSD sessions are initiated

by dialing specific codes rather than downloading applications or accessing

websites, there is minimal risk of phishing attacks or malware infiltration.

The use of USSD also offers convenience and speed. Transactions can be

completed swiftly with just a few keystrokes on the mobile device's keypad.

This eliminates the need for lengthy form-filling processes often associated

with traditional banking methods.

USSD-based mobile transactions provide a practical solution for individuals

seeking quick and secure ways to manage their finances on-the-go without

relying solely on internet connectivity or smartphone capabilities.

What is the USSD code for mobile banking?

USSD codes

have revolutionized the way we conduct mobile transactions, providing a

convenient and secure avenue for banking on-the-go. One of the most prominent

uses of USSD codes is for mobile banking, allowing users to access essential banking

services right from their smartphones.

To initiate a mobile banking transaction using USSD, users need to dial a

specific code provided by their respective banks. This unique USSD code acts as

a gateway to various financial services such as checking account balances,

transferring funds between accounts, paying bills, and even requesting mini

statements.

Each bank has its own designated USSD code for mobile banking. For example, if

you are an account holder with XYZ Bank in India, you might need to dial *XYZ#

or *99# to access your mobile banking services.

The beauty of using USSD codes for mobile transactions lies in its simplicity

and accessibility. Unlike other modes of digital payments that require internet

connectivity or smartphone applications, USSD-based transactions can be

performed on any basic feature phone with network coverage.

Additionally, the security aspect of these transactions should not be

overlooked. Since no information is stored on the user's device during a USSD

transaction and each session is encrypted end-to-end, the risk of data breaches

or unauthorized access is significantly reduced.

By leveraging this technology effectively while adhering to recommended

security protocols such as two-factor authentication and password protection

measures set by individual banks, customers can enjoy safe and seamless mobile

banking experiences without compromising their personal information.

What are the features of USSD?

USSD

(Unstructured Supplementary Service Data) is a communication protocol that

allows mobile users to access various services through a series of short codes.

One of the key features of USSD is its simplicity and ease of use. Unlike other

mobile applications or internet-based platforms, USSD does not require an

internet connection, making it accessible to users with basic feature phones.

Another important feature of USSD is its real-time interaction capability. When

a user dials a specific code, they are instantly connected to the service

provider's server for instant information retrieval or transaction processing.

This immediate response ensures quick and efficient communication between the

user and the service provider.

Furthermore, USSD transactions are highly secure due to their session-based

nature. Each session is initiated by the user dialing a specific code, which

acts as an authentication mechanism. Additionally, sensitive data such as

account details or PINs are not stored on the device itself but remain within

the network infrastructure, minimizing the risk of data breaches.

Moreover, USSD offers widespread compatibility across different mobile devices

and operating systems without requiring any additional software installations.

This versatility makes it accessible to a larger user base compared to apps

that may have compatibility limitations.

These features make USSD an attractive option for mobile transactions as it

provides convenience, security, immediacy in interactions and compatibility

across various devices - all without relying on internet connectivity or

complex applications

Is USSD banking safe?

Is USSD

banking safe? This is a question that many people have when it comes to using

USSD codes for mobile transactions. And rightfully so, as security should

always be a top concern when it comes to our financial information.

USSD banking, also known as Unstructured Supplementary Service Data banking,

offers a secure way to conduct mobile transactions. One of the key benefits of

USSD codes is that they do not require an internet connection, reducing the risk

of data breaches and hacking attempts. Instead, these codes are sent through

the GSM network directly from your phone to your bank's server.

Furthermore, USSD codes are encrypted during transmission, adding an extra

layer of protection to your sensitive information. This encryption helps

prevent unauthorized access and ensures that your financial data remains

private and secure.

Another safety feature of USSD banking is the use of PIN authentication. When

making a transaction using USSD codes, you will be prompted to enter a unique

PIN number that only you know. This adds an additional level of security by

ensuring that only authorized users can access and perform transactions on

their accounts.

While no system is completely foolproof, USSD banking has proven itself to be a

reliable and secure method for conducting mobile transactions. Banks

continuously invest in measures such as firewalls and intrusion detection

systems to safeguard customer data against potential threats.

With its offline nature, encryption technology, and PIN authentication process;

USSD banking provides robust security features for mobile transactions making

it a safe option for users looking for convenient ways to manage their finances

securely.

What are the limitations of USSD?

USSD codes have gained popularity as a quick and convenient way to perform

mobile transactions. However, like any technology, there are certain

limitations that users should be aware of.

One limitation is the dependency on network coverage. Since USSD operates

through cellular networks, it requires a stable connection for seamless

transactions. If you're in an area with poor network reception or experiencing

network congestion, your USSD transaction may not go through smoothly.

Another limitation is the limited functionality of USSD codes compared to other

mobile banking options. While they allow for basic tasks such as balance

inquiries and fund transfers, more complex operations like applying for loans

or managing investments may not be available via USSD.

Additionally, some banks impose transaction limits when using USSD codes. This

means that there might be restrictions on the amount of money you can transfer

per day or per transaction using these codes.

Furthermore, unlike internet-based platforms that offer real-time updates and

notifications, USSD transactions may take longer to process due to their

reliance on SMS messages. This delay could impact time-sensitive actions such

as bill payments or urgent fund transfers.

Another limitation lies in the user experience itself. The text-only interface

of USSD can sometimes make navigation and inputting information cumbersome and

time-consuming compared to more intuitive graphical user interfaces found in

mobile apps or web platforms.

Despite these limitations, many people still find value in using USSD codes for

their mobile transactions due to their widespread availability and ease of use.

It's important for users to weigh these limitations against their specific

needs before relying solely on this method for all their banking needs.

What are the risks of USSD code?

While USSD codes offer convenience and

accessibility for mobile transactions, it is important to be aware of the

potential risks involved. One risk is the possibility of unauthorized access to

your personal information. Since USSD codes are entered directly into your

phone's dialer, there is a chance that malicious individuals could intercept

and misuse your sensitive data.

Another risk is the potential for phishing attacks. Scammers may try to trick

you into disclosing your USSD code or other personal information through fake

messages or websites designed to resemble legitimate banking platforms. It's

crucial to stay vigilant and only use trusted sources when performing mobile

transactions.

Additionally, there can be security vulnerabilities in the telecommunication

network itself. Hackers might exploit weaknesses in the network infrastructure

or intercept communications between users and service providers.

Loss or theft of mobile devices poses a significant risk. If someone gains

access to your device without proper security measures in place, they could

potentially use your stored USSD codes for fraudulent purposes.

To mitigate these risks, it's important to take precautions such as regularly

updating your phone's software, using strong passwords or biometric

authentication methods, avoiding sharing sensitive information over unsecured

networks, and promptly reporting any suspicious activity related to USSD

transactions. Stay informed about security best practices provided by both

service providers and financial institutions so you can protect yourself while

enjoying the convenience of mobile transactions via USSD codes

What is USSD in Indian banking system used to

provide?

The Indian

banking system has embraced the use of USSD (Unstructured Supplementary Service

Data) codes to provide a convenient and secure way for customers to access

their accounts and perform transactions. USSD in Indian banking system is used

to offer various services such as balance inquiry, fund transfers, bill

payments, and mobile recharge.

With just a simple dialing of a USSD code on their mobile phones, customers can

easily check their account balance anytime, anywhere. This eliminates the need

to visit a bank branch or ATM for basic account information.

In addition to balance inquiries, customers can also use USSD codes for fund

transfers. By entering the recipient's bank details and authorization pin

through the USSD menu, users can transfer funds instantly without having to go

through lengthy paperwork or wait in long queues at the bank.

USSD in Indian banking system also provides a platform for bill payments. With

just a few taps on their mobile phones using USSD codes, customers can pay

utility bills like electricity, water, gas bills conveniently from wherever

they are.

Moreover, mobile recharge is another service that USSD codes facilitate in

India's banking system. Customers no longer need physical top-up vouchers;

instead they simply enter the appropriate USSD code followed by their desired

amount for prepaid recharges.

Overall,, with its simplicity and accessibility features provided by USSD codes

, it has revolutionized the way Indians conduct financial transactions on

digital platforms – making it easier than ever before!

How much can be transferred through USSD?

One of the

advantages of using USSD codes for mobile transactions is that they allow for

convenient and quick transfers. But have you ever wondered how much you can

actually transfer through this method? Well, the good news is that USSD has a

high transaction limit, making it suitable for both small and large transfers.

The exact amount that can be transferred through USSD may vary depending on

your service provider and the specific banking institution you are using.

However, in general, most banks set a daily transaction limit ranging from Rs

5,000 to Rs 2 lakh. This means that within a single day, you can transfer

anywhere between these amounts using USSD codes.

This flexibility in transaction limits ensures that users have enough freedom

to carry out financial transactions without any constraints. Whether it's

paying bills or transferring funds to another bank account, USSD codes make it

easy and hassle-free.

So whether you need to send money quickly or pay your bills on time, rest

assured knowing that USSD codes offer a secure and efficient way to manage your

finances while providing ample room for larger transactions when needed.

What is the USSD code for bank transfer?

In today's

fast-paced digital world, where convenience and security go hand in hand, USSD

codes have emerged as a game-changer for mobile transactions. These simple and

user-friendly codes offer a host of benefits that make them an ideal choice for

banking and other financial transactions.

One of the key advantages of USSD code is its high level of security. Unlike

traditional methods like internet banking or mobile apps, which require an

internet connection and are susceptible to hacking or phishing attacks, USSD codes

operate on a completely different platform. This means that your sensitive

information remains encrypted and secure throughout the transaction process.

USSD-based mobile transactions are not only secure but also incredibly

versatile. They can be used for various purposes such as balance inquiry, fund

transfers, bill payments, and even purchasing goods or services. With just a

few taps on your mobile phone keypad, you can complete these transactions

without any hassle or need for additional devices.

Each bank has its own unique USSD code for mobile banking. By dialing this

specific code on your phone's keypad, you gain access to a wide range of

features offered by your bank. You can check your account balance, transfer

funds to another account within the same bank or even to accounts in different

banks using the National Unified USSD Platform (NUUP).

The features provided by USSD codes include options like mini statements that

enable users to view their recent transaction history directly from their phones.

Additionally,National Unified Ussd Platform (NUUP) allows users to link their

Aadhaar number with their bank accounts through USSD service.

This further enhances security measures by adding an extra layer of

authentication while carrying out financial transactions.

While there is no denying the many benefits of using USSD codes for mobile

transactions,it is important to note some limitations associated with this

technology.

USSDs often have character limits,and sometimes lengthy menus may lead users to

mistakenly select incorrect options.

Consequently,a little bit more caution needs to be exercised while using USSD

code for banking.